Karuna Therapeutics, a drug repurposing effort, sold for about $14 billion. This is their story.

How to turn $100k into $14 billion with just 16 years of regulatory slog and a few hundred million in investment

Shoutout to Sacha Schermerhorn for telling me about Karuna in the first place.

About a month ago, Karuna Therapeutics, a drug repurposing effort, sold for $14 billion as pretty much a solo asset company. Depending on how you define drug repurposing, this is the biggest drug repurposing success of all time1. For me and my fellow drug repurposing entrepreneurs, this is incredibly heartening, doubly so for me as Karuna’s therapy is a combination repurpose of two old drugs, one meant to prevent the adverse effects of the other, which is the exact same path I’ve been following with both of my company’s drugs.

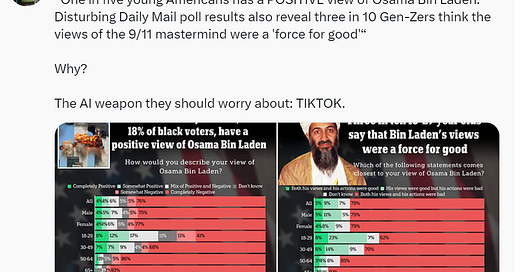

I’ve been disappointed but not surprised to hear crickets about this from the normally opinionated biotech venture capitalists (VCs). Even the voluble Robert Nelsen, whose Arch Venture firm owned almost 20% of Karuna when it IPO’d, made just a single post (and also retweeted the announcement post and a congratulations post) celebrating the acquisition, and then went back to tweeting about how TikTok is making Zoomers fans of Osama bin Laden.

So, I thought I’d be the one to tell the story. I’ve tried to piece this together from interviews, Karuna’s SEC filings, and journal articles. I wish I had access to their FDA filings, but those won’t be available until the company’s drug is approved (or not) in late 2024.

0. The idea behind a $14 billion company

Karuna’s story starts with a guy named Andrew Miller. He got his PhD in 2008 from MIT (go Beavers!) and immediately went to work for a company called PureTech. PureTech is a company which funds and spins out sciency companies. To be honest, a lot about PureTech is weird: the founder, Daphne Zohar, is a self-described serial entrepreneur whose previous ventures were an olive oil brand and hoof pads for race horses; their other funded ventures include CBD for epilepsy, a videogame for ADHD, and a weight loss supplement that’s just a chunk of cellulose (as well as some more traditional biotech ventures); and their stock is listed on the London Stock Exchange even though they’re entirely America-based.

However, I guess they had what Dr. Miller needed, mainly capital and a willingness to spend it on weird things. Almost immediately after he joined, a paper was published by Eli Lilly scientists about a small pilot trial of xanomeline in schizophrenia. Xanomeline is a muscarinic agonist that Eli Lilly and Novo Nordisk had developed for Alzheimer’s back in the 90s, which seemed to be effective at treating the behavioral symptoms of Alzheimer’s (i.e. dementia and psychosis). Eli Lilly had stopped development of this drug because, basically, xanomeline was too effective of a muscarinic agonist. While it successfully agonized (activated) muscarinic receptors in the brain, preventing psychosis, it also successfully agonized the muscarinic receptors in the rest of the body, causing nausea and vomiting.

Reading this paper 16 years later, I can clearly see the same thing that Dr. Miller saw, which is obviously also what these Eli Lilly scientists were trying to convey. Xanomeline is a relatively safe drug with a novel mechanism of action that works way better with way fewer side effects than existing drugs for psychosis. It deserved better than its shelving by Eli Lilly.

If I had to guess, I’d bet these Eli Lilly scientists expected this to spur innovation in developing new muscarinic agonists. They spend a lot of the paper talking about what they think the mechanism for muscarinic agonism in psychosis is, which is modulating the dopamine response2, as proven by its effect on blocking the effect of dopamine agonists.

But, Dr. Miller took their results in a different direction. He looked instead for a muscarinic antagonist that could block xanomeline’s effect on the body, so xanomeline would only agonize muscarinic receptors in the brain. He eventually settled on trospium, an antimuscarinic medication used for overactive bladder that’s been around since the 70s and does not cross the blood brain barrier3.

From there, Dr. Miller and PureTech licensed xanomeline from Eli Lilly for $100k and promises of milestones. In retrospect, this was unnecessary, because xanomeline was already old then and became generic by 2016, but perhaps they were feeling overambitious in terms of timelines. And then…that was it! That was the drug.

Well, that wasn’t entirely it. They still had 16 years and $200+ mm of clinical trials to get through before the drug could be approved and the company be acquired.

And that, of course, is the downside of drug repurposing. The fun part, the sciency part, is over pretty quickly and then what’s left is the regulatory slog. You don’t need a PhD to understand the science, either, just basic logic. To recap: muscarinic agonists can treat schizophrenia, probably by modulating dopamine receptors. Xanomeline is an effective muscarinic agonist for both the brain (good for schizophrenia) and the body (bad for nausea). Trospium is a muscarinic antagonist for just the body because it can’t reach the brain. Combine the two, and you get muscarinic agonism in only the brain, and schizophrenics are better off.

There was a tremendous amount of work (and money) that went into producing the knowledge in the previous paragraph. Eli Lilly and Novo Nordisk spent likely hundreds of millions developing xanomeline, testing it for safety and efficacy, and understanding its relationship to muscarinic receptors. All of that original work they definitely needed PhDs for. The original developers of trospium spent a lot of money and time, too. But Dr. Miller and PureTech didn’t have to do any of that work. They just received it, in the same way you and I did, and probably understood it in the space of a week in the same depth as they did 16 years later. This is not particularly fun from a scientist’s perspective, so most people don’t want to hear about these 16 years of no new knowledge.

But this is a pity, because these 16 years of regulatory slog were important. They were the difference between a worthless drug that Eli Lilly was willing to let go for $100k in licensing fees and a drug that Bristol Myers Squibb was willing to buy for $14 billion, not to mention possibly the first treatment for schizophrenia that’s not terrible. So, in order to figure out what actually happened, we’re going to need to embrace the slog.

1. The patent (a.k.a. the first slogging step)

After licensing xanomeline (which, as mentioned, was, in retrospect, unnecessary), the first regulatory step was the patent. VCs occasionally freak out about this step, because they worry that it’d be impossible to develop a strong patent for a repurposed drug or that someone else will challenge and invalidate it. In truth, this never happens. If you want a patent on something, you can get it even if it’s stupid, and it’s actually quite hard to invalidate it.

PureTech’s original patent is a great case in point. They got a patent on combining xanomeline and trospium even though it’s an obvious thing to do. Their patent’s “concrete evidence” for why this was novel and non-obvious is that they listed the 65 muscarinic agonists and 114 muscarinic inhibitors that they found in the literature in a table. From this, they came up with 7410 possible combinations (65*114), which they allegedly ranked based on efficacy and side effects. After all of this, they found that the best combination was…the same drug they had read about in Eli Lilly’s paper, and then a really safe drug from the 70s. Surprise! This was their “invention”.

Since then, they’ve added some additional patents based off of their in-vivo data. But, still, the basic idea remains the same and the original patent has not been invalidated even though it’s obvious. So, an Excel table can be the intellectual property basis of a $14 billion drug. VCs can stop freaking out.

The next steps were more difficult.

2. Testing the combination in healthy volunteers

In normal human drug development (i.e. discovering new chemical entities or biologics), the steps to getting to approval are something like the following, with each step carrying the implicit possibility of failing and having to go back to the previous step or even all the way back to the beginning:

a) Get idea for target receptor and possible means of hitting target

b) Manufacture first, small, artisanal batch of drug. Test it in petri dishes (in vitro) and possibly in some kind of lab animal (in vivo)

c) Develop and manufacture the form of the drug that you will want to use in humans. Prove that this formulation is shelf-stable

d) Test the drug in two species of animals and perform clinical pathology (a.k.a. clinpath, a.k.a. dissecting the animals and checking their organs for damage) in order to see if the drug is safe

e) Test the drug in at least one Phase 1 trial in healthy volunteers for safety and to see how the drug behaves in the human body

f) Test the drug in at least one Phase 2 trial in sick volunteers for safety and to see how the drug impacts the disease

g) Test the drug in at least one Phase 3 trial in sick volunteers to prove the drug has the effect on the disease you say it will

h) Monitor the drug in at least one Phase 4 trial in patients who are paying to take your drug to prove the drug is actually working and to see if you can expand the patient population

In drug repurposing, you’re working with drugs that have already been proven safe in animals and humans and that have been proven to be shelf-stable. Often, you’re working with drugs that already have evidence in the disease that you’re trying to treat like in Karuna (and my company’s) case.

So, all steps pre-healthy human volunteers are done already (steps a-d), you can be pretty confident about safety in humans, and you can be somewhat confident about efficacy in humans. That’s a huge leg up in both speed of development and in cost of development.

So Karuna, once they got their ducks in a row, were able to jump ahead to step e, and test directly in healthy volunteers. Unfortunately for Dr. Miller, getting ducks in a row apparently took a while. As far as I can tell, his timeline to get to step f, the phase 2 trial, ended up being something like this:

i. Join PureTech in summer 2008.

ii. Convince PureTech to patent xanomeline/trospium in 2010.

iii. License xanomeline in May 2012.

iv. Spend 3ish years slowly getting $13 mm more funds from PureTech under some very complicated royalty/intellectual property sharing agreement (I guess because Dr. Miller wanted to be separate from PureTech)

v. Run a successful phase 1 trial that showed xanomeline/trospium had a lower rate of adverse effects than xanomeline alone

vi. Somehow, raise $3.5 mm more from a British nonprofit, the Wellcome Trust, even though, on their website, it doesn’t look like they invest in for-profit entities

vii. Hire a separate team for Karuna outside of PureTech

viii. Run an additional phase 1 trial in healthy volunteers to find the optimal dose in healthy volunteers

ix. Raise a huge new round from Arch Ventures, Sofinnova, and the Wellcome Trust to get $85 mm in the bank by December 2017

x. Finally start a Phase II trial in people with schizophrenia September 2018

The crazy thing is that, if you look at their financial disclosures in their S1, the entirety of the funding needed to get Karuna to step x here was under $5 mm, including salaries. And, given that these were healthy volunteer trials and Karuna was using generic APIs (i.e. drugs that were already known to be shelf stable and easily coformulated), the entirety of the scientific work (steps v and viii) involved here probably was about 8 months or so.

In other words, if someone had just given Dr. Miller $5 mm in summer 2008, he probably could have been at step ix by summer 2010, accounting for lead times. But, unfortunately, nobody did, so it took him 10 years. Fundraising ended up, once again, being by far the biggest bottleneck in scientific progress. This is definitely not something I have any experience with, though. Nope, not at all. Not at all…

Anyways, onto the next step.

3. Testing the combination in sick volunteers

From my point of view and from the point of view of most repurposing folk, Karuna was basically done by the time they ran their first trial in healthy volunteers and showed a lower rate of adverse effects with the combination than with xanomeline alone. It was obvious from the existing trials that the combination would work at least as well as xanomeline in schizophrenia and be safer than xanomeline alone. Given that xanomeline alone is already pretty safe and, from Eli Lilly’s small trial in schizophrenia, looked effective in schizophrenia, xanomeline/trospium was a shoo-in.

The FDA, unfortunately, does not see it that way, and neither do traditional drug development companies. They see trials in healthy volunteers (a.k.a. Phase 1 trials) in drug repurposing as equivalent to Phase 1 trials in new chemical entities. That is, they are good first steps, but by no means the end of the road.

So, that’s why Karuna had to raise a huge amount of money. Not coincidentally, by this point, Dr. Miller was also already demoted to the Chief Operating Officer at Karuna and was left with only 1.3% of the company at time of IPO. His new CEO, a big-named guy named Steven Paul who had not only helped develop xanomeline at Eli Lilly but also had been the scientific cofounder of a couple high-profile biotech startups4, had joined the company in August 2018, right before the IPO, and somehow owned 8% of it, possibly by investing some of his own money.

Raising huge amounts of money in the biotech world is costly. People do it because they have to, but, to be frank, Dr. Miller was lucky to get away with still having a high level position and >1% of the company after raising such a big sum. Biotech works by the golden rule: he who has the gold makes the rule. Ideas and sweat equity are worth very little.

But, that’s the way the game is played. Anyhow, Karuna raised the money and started on their first big trial: a double-blind, placebo-controlled trial of 182 patients over 5 weeks in a multi-center trial. It took them about a year to announce results, and they found, unsurprisingly to me, that xanomeline/trospium (which at this point they had named KarXT) was safe and effective at treating schizophrenia.

It might seem weird to you that it would take over a year to get 182 schizophrenic people to complete a 5 week trial, given that there are roughly 24 million schizophrenic people in the US. It might seem even weirder that that trial took $20 mm, given that the cost of materials was just a few hundred thousand, and that money would account for 100 doctors being paid $200k each.

Well…it is kind of weird. Everyone knows it’s weird, and there are a bunch of startups with a business model of “we can cut this cost in half and still make a ton of money”, although it remains to be seen if any of those startups will be successful. To be fair to Karuna, they did have a difficult task: it’s hard to think of a more difficult patient population to treat than schizophrenics, especially because they required these schizophrenics to “wash out” of their current antipsychotics (i.e. quit them) for 5 weeks before starting the trial. Getting an unmedicated schizophrenic to show up for a trial on time, especially if they’re in the placebo group, has got to be a nightmare for everyone. But still, it is always somewhat of a mystery why clinical trials cost so much.

Regardless, Karuna completed the trial successfully and for a reasonable amount of money, by biotech standards. Along the way, they started doing big company things, probably because they suddenly found themselves with almost $400 mm from their IPO. So, their administrative costs (outside of their trial) skyrocketed from $3mm to $21 mm, they leased 10,000 square feet in Boston and an additional 5000 square feet in Indiana for office space, and they launched pilot trials in pain and dementia-related psychosis.

I have mixed feelings on this sudden cost surge. My viewpoint is naturally to be scrappy and cost-efficient, and I am really not sure what the point of all this office space and new staff is when you really only have one drug that’s being built by contractors anyways. On the other hand, the dementia-related psychosis indication was specifically cited by Bristol Myers Squibb as a reason they bumped up their acquisition price to $14 billion, in addition to the schizophrenia stuff. On the other, other hand, they didn’t need dozens of extra PhDs to run that trial, because that was literally the same indication that xanomeline was initially developed for, so a lot of the evidence was there already.

But, whatever. Nobody asked me. Karuna spent a ton of money, got their phase 2 trial done successfully, and could now get to phase 3 trials.

4. Testing the combination to see if it works

Here’s where things get a little strange for me, and I think there was some kind of big company politics involved. So, the FDA tells Karuna that they need to run their big phase 3 trial to prove definitively that xanomeline/trospium can treat schizophrenia. They also want to run additional, short trials for xanomeline/trospium in schizophrenia-related psychosis, and figure out their dosing for elderly people for dementia-related psychosis. They’re also pursuing a new pain indication for some reason, which seems pretty baffling from a scientific perspective but is not much money in the grand scheme of things.

Ok, cool. They do that. They spend 2021 getting their phase 3 underway, doing their short, 5 week trials in schizophrenia-related psychosis, and doing some additional trials in dementia-related psychosis. They spend like $30 mm on all this, and an additional $15 mm on other research and development…stuff. It’s hard to say exactly, but, then again, it’s not really making a dent in their warchest. Neither is the sudden $9 mm jump in salary cost, but it is worrying.

And then 2022 rolls around, and Karuna announces that they’ve now started 3 new Phase 3 trials around the world, all in schizophrenia: one 5 week one in the US, one 5 week one in Ukraine and the US, one year long one in Puerto Rico and the US, and another year long one in the US alone. And their explanation is hard to parse. They say they want more data on how it can be used in schizophrenia, including whether it can be used as an adjunct to other drugs.

Now their trial costs have ballooned to over $100 mm per year, their salary costs have just about doubled to $50 mm a year, and their cash position is a lot more precarious. It’s baffling. Like…why? They were close to getting approved in schizophrenia, there weren't any other schizophrenia treatments on the horizon that they needed to compete against, and any questions about xanomeline/trospium could have been answered for much cheaper after it was approved. And then, simultaneously, they licensed their drug for sale in China for $35 million up front, which was a relative pittance and took away a potential major revenue source.

All of this put them in such a rough cash position that they then needed to sell more stock and raise more cash, which further diluted everyone. This all seems like such a bad idea that I can only think that someone behind the scenes had a crisis of faith and decided that they needed to stack the deck in Karuna’s favor in every way by running a bunch of phase 3 trials and by getting a small revenue stream. I guess this just goes to show that, once you’re a public company, it’s even more difficult to control activist shareholders than when you’re private, but, shoot, I bet Dr. Miller was pretty angry by the end of all this.

5. Selling the company

By 2023, Karuna had gone full big company by not only starting 3 new phase 3 trials in dementia-related psychosis, but also licensing some random drug for anxiety from a different biotech startup, with everything combined pushing them over $200 mm in R&D costs, a doubled 240 person workforce, and a new CEO from Allergan.

And then…it was over. Well, for our purposes at least. Karuna announced in October 2023 that their Phase 3 trial in schizophrenia was successful (which, for the record, was the same Phase 3 trial they had planned all along before the madness), the big drug companies smelled the opportunity; there was a brief bidding war; and after about two months negotiation Karuna got sold for $14 billion. And that was that.

Kind of a let down, after everything. There wasn’t some cool near death experience or grand scientific discovery. There was just a clearly useful drug and a clever drug combination that seemed back in 2008 like it would probably work, and 16 years and a bunch of money and effort later, it did work and a bunch of people made a bunch of money.

6. What have we learned?

I hope the biggest thing that we’ve learned is that drug repurposing can be a really, really lucrative business and does not require a lot of brilliance or luck. Dr. Miller took two generic drugs, one of which had already been developed for schizophrenia, protected them with a weak patent, and eventually sold that combination for $14 billion for schizophrenia.

If the company’s leadership had been more cost conscious, they probably could have done all of that for like $50 mm total, but, as it was, it came out to more like $400 mm. Still, an amazing return.

Maybe this doesn’t seem like a particularly surprising lesson to you. But, I can tell you, it is for biotech VCs. Biotech VCs are, for the most part, a superstitious bunch, and drug repurposing doesn’t fit in a VC’s idea of what successful drug development is supposed to be. Drug development, for a VC, is supposed to start with a discovery at a university, preferably by a famous professor at a name-brand university. This professor discovers some new way of manipulating the body that has a million different applications. The professor works together with a graduate student to illuminate at least one or two of those.

At that point, paper in hand, the graduate student and the professor go to VCs, discovery in hand. “Look,” they say to the VCs, “we were able to have these cool results with just our laboratory’s resources. Imagine what we could do with millions of dollars and 80 PhDs!”

The VCs agree. They give the graduate student millions of dollars, but also a bunch of “adult supervision” in the form of executives that the VCs know and trust. The VCs also probably take majority control of the company. They work to develop a bunch of possible drug ideas based on the professor’s discovery. Then the company raises a boatload more million dollars from a few additional VCs and makes a press announcement that they now have $100 million dollars, backing from famous VCs, and 12 different drug ideas, at least one of which is ready to move into humans sometime soon.

At this point, the hype cycle is in full swing. Pretty soon, the company will IPO based on these incredible promises, the VCs will make back their money from retail investors, and then, well, it’s not the VCs’ problem whether the company succeeds or not. Most likely the company’s valuation will drift slowly downwards as the promises fade out and it becomes increasingly clear that the drugs will never actually become approved in humans, but maybe the drugs will succeed and the company will do well. It doesn’t matter either way.

In this story, the sizzle is always worth more than the steak. The VCs make their money regardless of whether the drugs work or the professor’s incredible discovery was never so incredible after all, because they only needed the drug ideas to be exciting enough to sell the stock to retail investors. So, if you or I see a stock like bluebird bio or Ginkgo’s, we think, “Man, what a waste,” but VCs see the IPO price and think, “Damn, I wish we had some failures like that in our portfolio.”

This is a big part of why VCs have been so quiet about the incredible success of Karuna. Karuna was public when it was acquired and, instead of drifting downwards, went upwards. Arch Ventures, who would’ve made about $3 billion if they had kept their stock until the company was acquired, instead had less than 1% of the company at the time of sale (and possibly none, it’s hard to tell) and probably made about $200 million off their investment.

To be cynical about it, the story that VCs prefer where a brilliant discovery enables a drug engine that can spit out a bunch of different profitable drugs (or, in biotech parlance, a platform) is less because they think that makes for a better company and more because they think that makes for a better story for retail investors. After all, preferring a platform to a drug only makes sense if you think all drugs have the same, indefinite chance of success. Otherwise, it’s like a boxing coach saying, “Yeah, I could focus my efforts on developing this 15 year old kid named Mike Tyson who is insanely strong and fast, but I’d rather try to coach these 10 random high school students instead. After all, Mike Tyson’s just one guy, but any of these kids could be a champion!”

So, if you have a biotech VC in your life, try sitting them down and gently asking them if they’d be open to a nontraditional route to developing a drug. If they seem open to it, explain drug repurposing to them, and how running confirmatory clinical trials for a drug that already has clinical evidence can be a better use of money than early stage discovery, especially if they don’t insist on selling all their stock at IPO. You’ll be doing them, and the world, a favor.

Sildenafil comes to mind as an incredibly successful sort-of drug repurposing. It was developed as a blood pressure medication and got all the way through healthy volunteer trials before they noticed it had a fascinating side effect. So, Pfizer repurposed it as the first erectile dysfunction medication, renamed it Viagra, and it peaked (no pun intended) at $1.8 billion/year. But it never left Pfizer’s hands, so I’m not sure I’d classify it as drug repurposing in the same way.

There’s a fascinating connection regarding the connection between dopamine and psychosis. If we think of dopamine as a reward chemical in the Bayesian sense (weight this higher), then psychosis is a result of that going haywire, and rewarding the wrong learning so people find the wrong things significant (the newscaster looked at me so he must be talking about me). It also has the same effects on movement, which is why people on dopamine agonists have “extrapyramidal symptoms”, literally uncontrollable movements. I think it’s basically someone twitches a little bit, and then they get the dopamine reward to move a lot more.

Really weird connection here: the old schizophrenic medications, like olanzapine (Zyprexa) and risperidone (Risperidal) are actually muscarinic antagonists, among their many other effects. Xanomeline, as you should remember, is a muscarinic agonist. Looking from my perspective 16 years later, I feel confident in just saying “mental illness is complicated and these old drugs hit many targets, some of which may be useless or even counterproductive”, but I’m sure that fact was brought up numerous times throughout the development of xanomeline and Karuna’s combination as an argument against them.

Scientific co-founder is something that sounds impressive but it’s really hard to know what it actually means. If a young guy is a scientific cofounder of a biotech, it probably means that he’s working his butt off in the company’s lab every day and knows the minutiae of every single experiment the company is running. If an old guy is a scientific cofounder of a biotech, it probably means he just shows up once a week to talk to investors and reassure them. Given that Steven Paul was old when he became the scientific co-founder of two separate companies, his duties were probably closer to the latter than the former, which is a pretty sweet gig if you can get it.

Great post! Would love to see something similar on another repurposing story - neurokinin-3 receptor antagonists going from failed schizophrenia drug to successful menopausal treatment

https://open.substack.com/pub/rationalpsychiatry/p/repurposing-a-failed-class-of-schizophrenia?r=g83wq&utm_medium=ios

Incidentally (re: footnote), sildenafil (and presumably other PDE5 inhibitors) has shown promise in treating moderate to severe menstrual cramping when administered as a vaginal suppository. I wouldn’t be surprised if drug repurposing could be used as as an avenue for treatment of lots of different underserved conditions (similarly, there’s lots of folk evidence for the use of pepcid’s active ingredient in treating PMDD).